Venmo

The Venmo app has revolutionized the way people transfer money and split expenses. Developed by PayPal, Venmo offers a convenient and secure platform for sending and receiving payments among friends, family, and even businesses. With its user-friendly interface and social elements, Venmo has become immensely popular, making financial transactions more accessible and enjoyable.

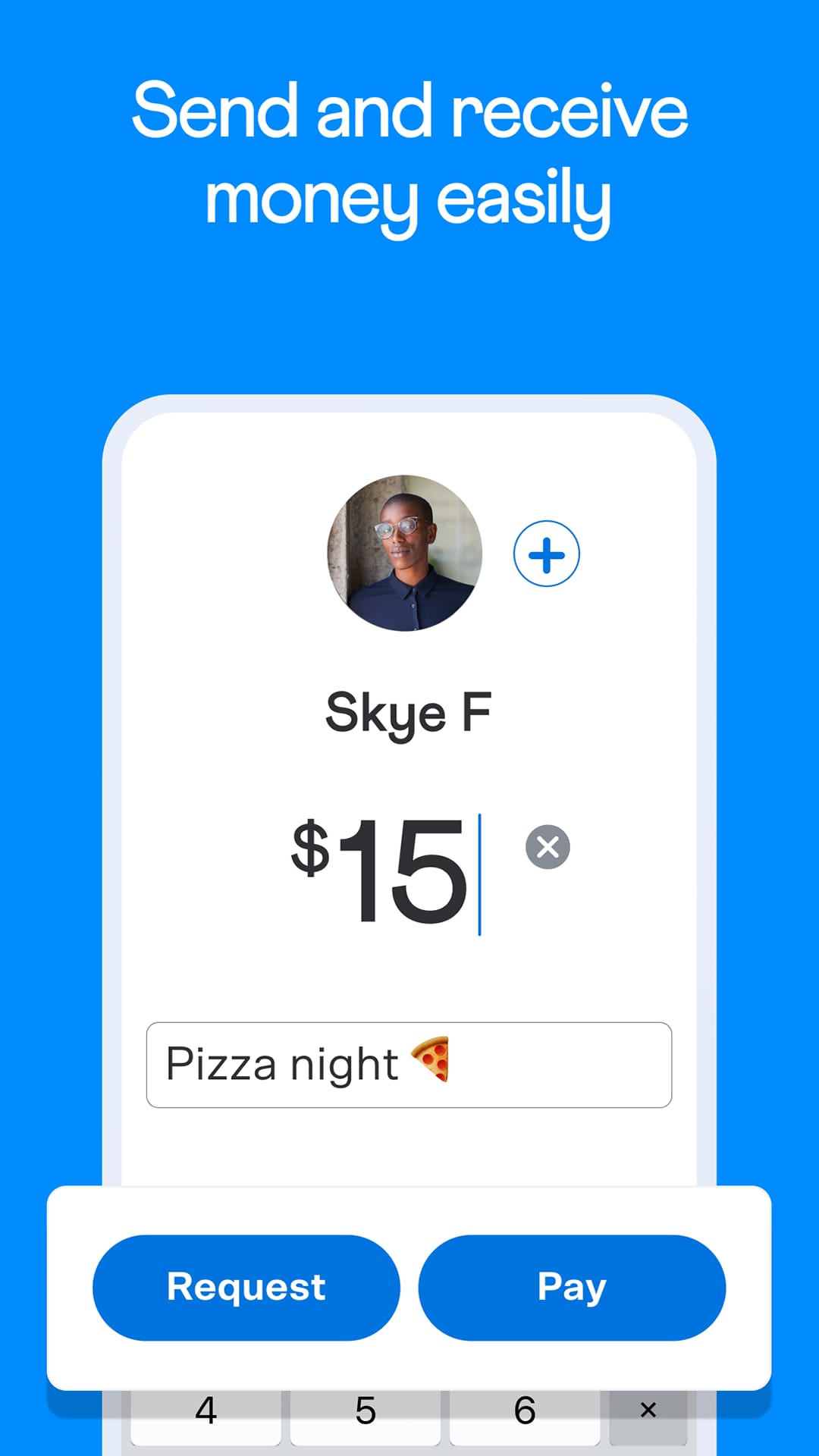

Venmo simplifies the process of sending money to individuals or groups. Whether you’re splitting a dinner bill, paying rent to a roommate, or chipping in for a gift, Venmo provides a seamless way to handle these transactions. The app’s social features also add an element of fun and engagement, allowing users to like and comment on transactions, adding a social media-like experience to their financial interactions.

| |

Venmo |

| Rating: 4.2 | |

| Downloads: 50,000,000+ | |

| Category: Finance | |

| Developer: PayPal, Inc. |

Features & Benefits

- Easy Money Transfers: Venmo allows users to send money to friends or family with just a few taps. Whether it’s splitting a restaurant bill, paying rent, or sending a birthday gift, Venmo streamlines the process, making it quick and convenient to transfer funds.

- Social Payment Feed: The app’s social feed feature adds a unique social element to transactions. Users can see and interact with their friends’ payment activity, leaving comments or emojis, creating a more engaging and interactive payment experience.

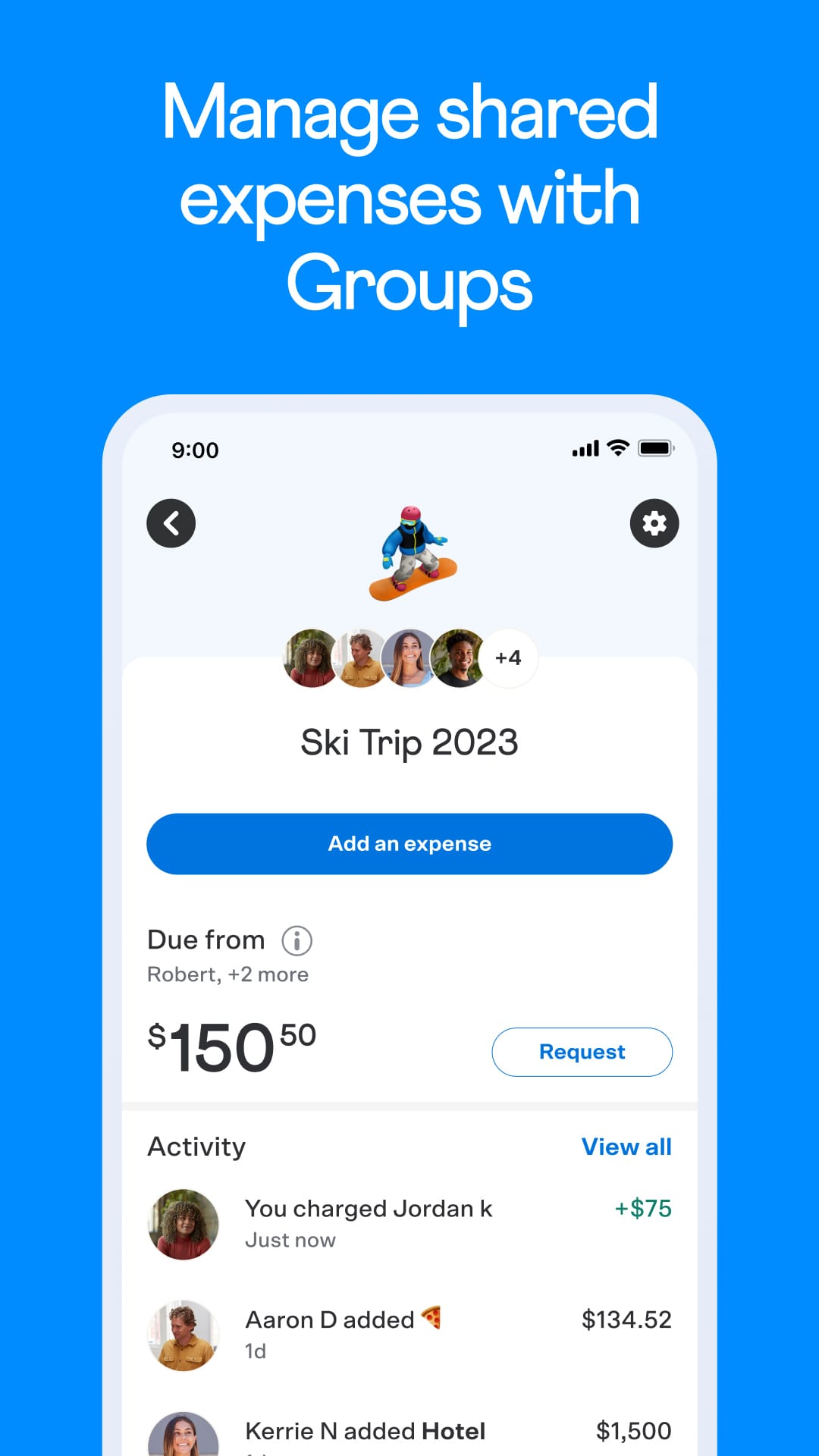

- Splitting Bills Made Simple: Venmo simplifies splitting bills among friends. Users can split expenses for meals, group outings, or shared expenses like rent or utilities, making it easy to keep track of who owes what and settle payments within the app.

- Seamless Integration with Bank Accounts: Venmo offers seamless integration with users’ bank accounts, debit cards, and credit cards. This allows for easy transfers between Venmo and bank accounts, making it convenient to access and manage funds.

- Security and Buyer Protection: Venmo prioritizes security and provides buyer protection for eligible transactions. It employs encryption and security measures to protect users’ financial information and offers dispute resolution options in case of unauthorized transactions or issues with purchases.

Pros

- Convenient Peer-to-Peer Payments: Venmo simplifies the process of sending and receiving money between individuals, making it easy to split bills, repay debts, or share expenses without the need for cash or checks.

- Social Payment Experience: The app’s social aspect adds a fun and interactive element to transactions. Users can view and engage with their friends’ payment activities, creating a unique and engaging payment experience.

- Multiple Payment Options: Venmo offers various payment methods, including bank transfers, debit cards, and credit cards, providing flexibility for users to choose the option that suits them best.

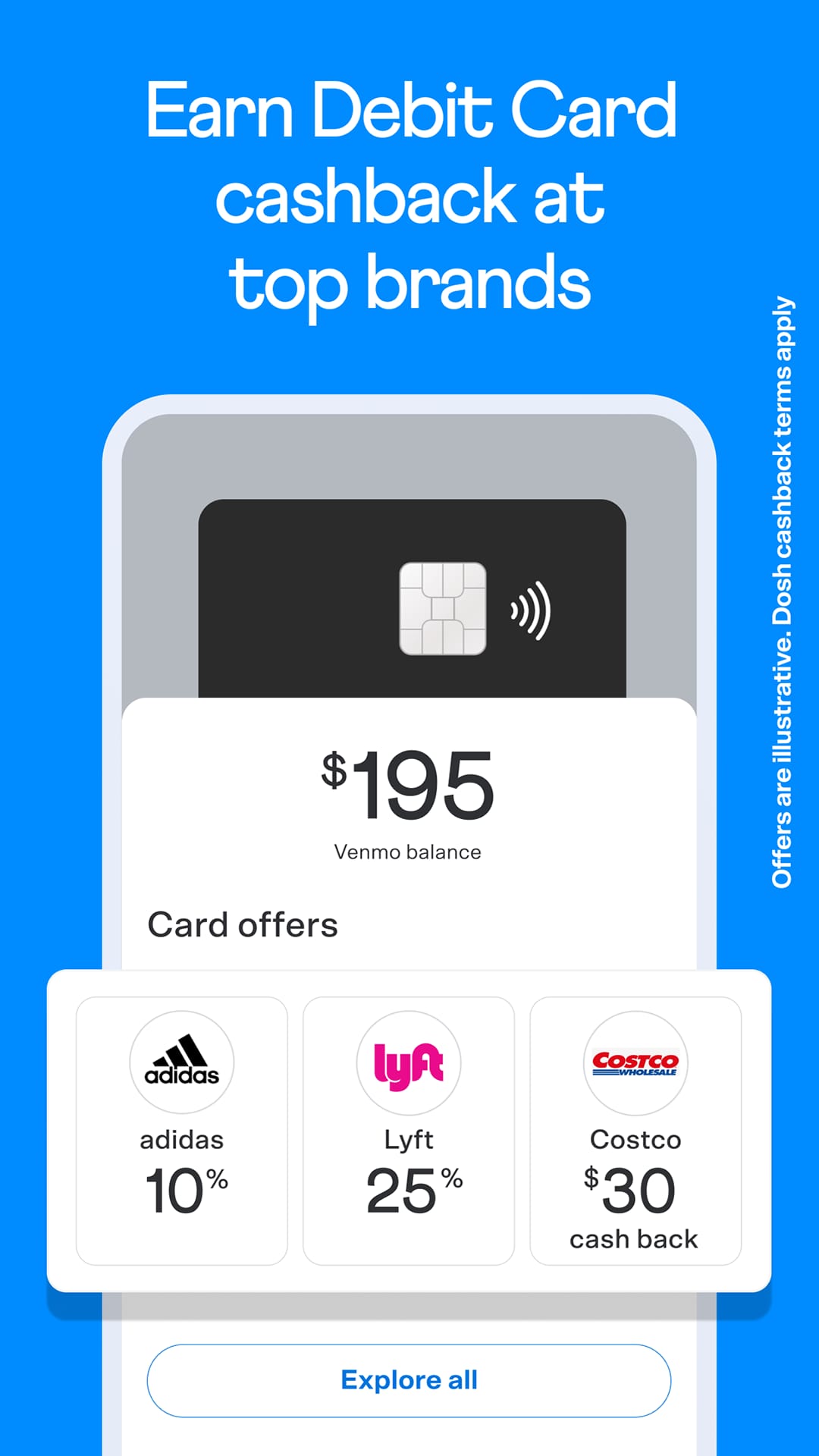

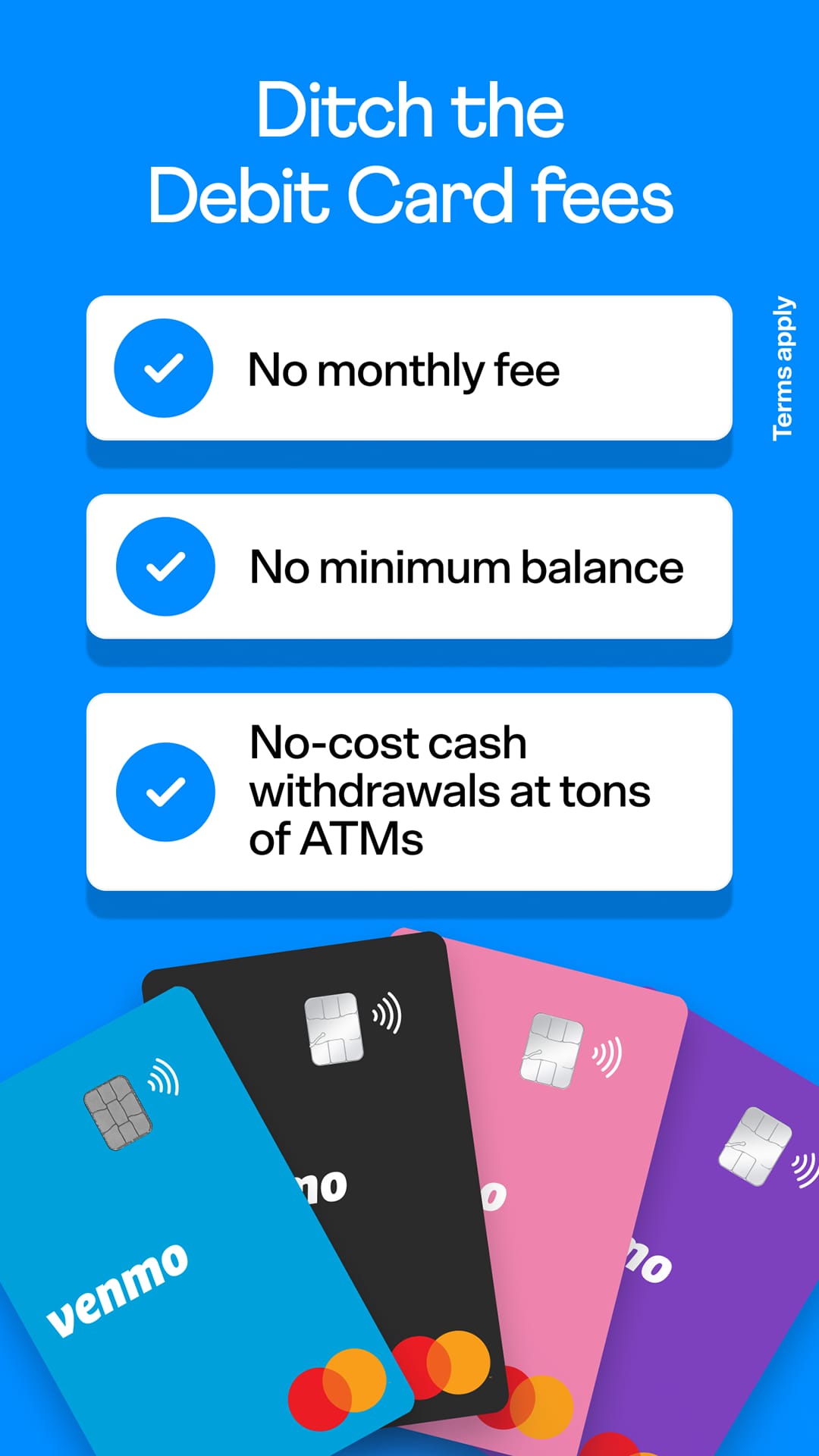

- Venmo Card: The Venmo debit card allows users to access their Venmo funds and make purchases at any merchant that accepts Mastercard, providing a convenient payment solution in both online and offline settings.

- Merchant Integration: Venmo’s integration with merchants streamlines the payment process, allowing users to make purchases directly through the app without repeatedly entering payment information.

Cons

- Privacy Concerns: The social aspect of Venmo, while fun, may raise privacy concerns for some users who prefer to keep their financial transactions private.

- Transaction Limits: Venmo has transaction limits that restrict the amount of money that can be sent or received within a specific time frame. This limitation may inconvenience users who need to make larger payments.

- Transaction Fees: While Venmo offers free transactions between friends, it charges fees for certain transactions, such as instant transfers or payments made using a credit card. Users should be aware of these fees to avoid unexpected charges.

- Limited International Availability: Venmo is primarily available in the United States, which may restrict its usage for individuals residing in other countries or for international transactions.

- Customer Support: Some users have reported difficulties with Venmo’s customer support, finding it challenging to resolve issues or receive timely assistance.

Apps Like Venmo

Cash App: Cash App, developed by Square, provides a peerto-peer payment service that allows users to send and receive money quickly. It also offers features like a Cash Card for making purchases and investing in stocks.

Google Pay: Google Pay allows users to send money, make online purchases, and store loyalty cards. It also offers contactless payment options through NFC technology, making it easy to pay with a smartphone.

Zelle: Zelle is a digital payment network that enables users to send money directly to bank accounts in the United States. It is often integrated into banking apps, making it convenient for users to transfer funds.

Screenshots

|

|

|

|

Conclusion

In conclusion, the Venmo App has revolutionized the way people transfer money and split expenses. With its easy-to-use interface, social payment feed, and seamless integration with bank accounts, Venmo offers a convenient and efficient platform for peer-to-peer transactions. It simplifies the process of splitting bills among friends and provides a secure environment with buyer protection. However, it’s important to consider the app’s limitations, such as its limited international availability and transaction fees. Nonetheless, Venmo has garnered positive reviews from users who appreciate its convenience, social features, and enhanced payment experience. Whether you’re settling payments with friends, splitting expenses, or making purchases, Venmo remains a popular choice for mobile payments.