GO2bank

Brief:

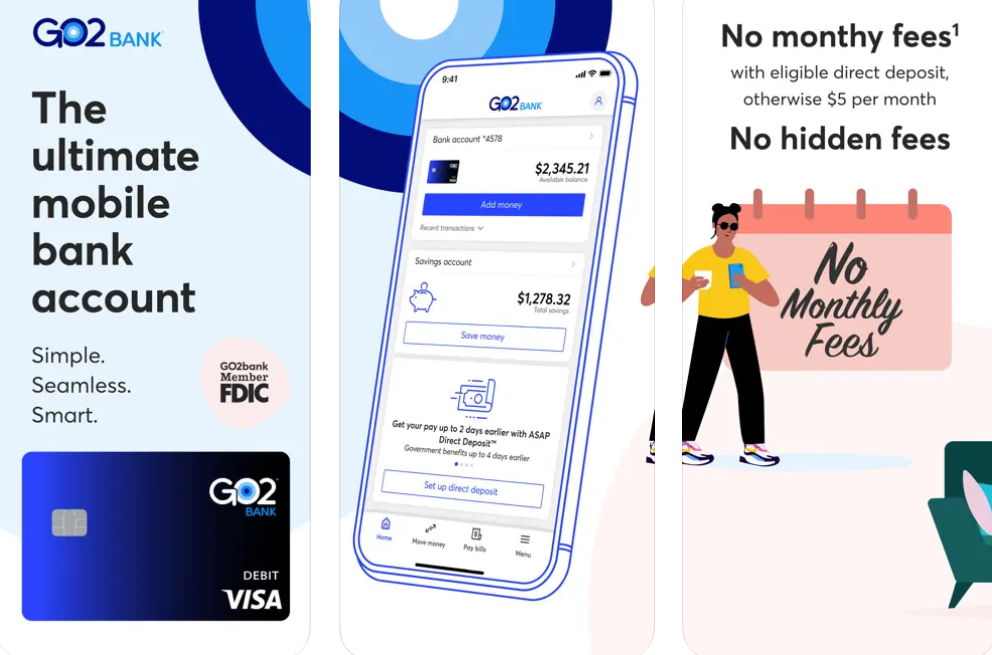

GO2bank is the ideal mobile banking app and debit card, packed with features that will assist you in better managing your money and building your credit. GO2bankTM is available for both Apple and Android devices.

Features:

- If you make an approved direct deposit, there are no monthly fees; otherwise, there is a $5 cost every month.

- Free countrywide ATM network

- Overdraft protection of up to $200, provided the customer opts in and their direct5 deposit meets the requirements

- With direct deposit, you can receive your pay up to two days earlier than usual.

- Earn more than ten times the average savings rate in the nation

- Receive a cash back bonus of up to 7% on eGift Cards purchased through the app4

How to uninstall the application:

- Go into your settings

- Go into the Applications Manager

- Uninstall the GO2bank app by selecting it and clicking Uninstall.

Disclaimer:

- This software is a mobile application that will not modify the system settings of your phone.

- We provide the official Apple Store download link.

- All apk downloads obtained from our website are 100% safe.

- There are no trademarks or logos belonging to their respective owners on the website. None of them are connected to or associated with this website.

- Our website and its content comply with all Google Ads Advertising guidelines and Google Unwanted Software policy standards and restrictions.

Tips:

1. Your monthly charge will not be assessed if you had a direct deposit of payroll or government benefits during the month prior to the current month’s statement period.

2. Check the app for locations of free ATMs. The fee for withdrawing money from an ATM that is not part of your network is $3, in addition to any other fees that the ATM owner or bank may levy. There are restrictions imposed.

3. If the account is in good standing and has a balance of at least $5,000 at the end of each quarter, interest will be paid on the account based on the average daily amount for that quarter. Your earnings on your savings account may suffer as a result of the fees assessed to your primary deposit account. The Federal Deposit Insurance Corporation (FDIC) has determined that the average interest rate for national savings accounts should be 0.06 percent as of 4/18/22. For further information, please go to https://www.fdic.gov/regulations/resources/rates/.

4. An active debit card that supports chip technology is required in order to purchase eGift Cards. To be able to get eGift Cards, you need to have a valid GO2bank account. The merchants who accept eGift Cards are subject to change.

5. A chip-enabled debit card that has been activated and opted into is a need. A fee of up to $15 could be assessed for each qualifying purchase transaction that causes your account to go into the red. In order to avoid being charged a fee, your account must have a balance of at least zero dollars within twenty-four hours of the authorization of the first transaction that causes it to go into overdraft. We need prompt payment of any and all overdrafts, as well as any associated fees. Overdrafts are covered at our discretion, and there is no guarantee that we will authorize and cover any particular transaction.

6. The early availability of direct deposit is contingent on the time of the payor’s payment instructions, and there may be limits in place to avoid fraud. As a consequence of this, the availability of early direct deposit or the timing of it may differ from one pay period to the next.

7. This feature is only accessible to GO2bank account holders who have received a direct deposit of at least $100 in the preceding 30 days. There is a requirement for a security deposit in addition to the eligibility conditions.

Review:

At the moment, I am pleased with my decision to use the GO2Bank and the GO2Bank Credit Building accounts. At the moment, I believe that I have chosen and made the right decision to do this as I am trying to fix and rebuild my credit as my husband to be and I are trying to buy a home in the very near future and my credit is damaged because of my first marriage and his is a little of two things: either he has none or very little credit, or his first marriage as well has played As a result, with the help of these credit cards, we plan to establish and reestablish a credit limit that is larger and more favorable for the both of us, and we pray that within the very near future, we will be able to buy the house of our dreams!